Tuesday, 4 October 2011

Senate Moves to Punish China for Yuan's Low Value (Video)

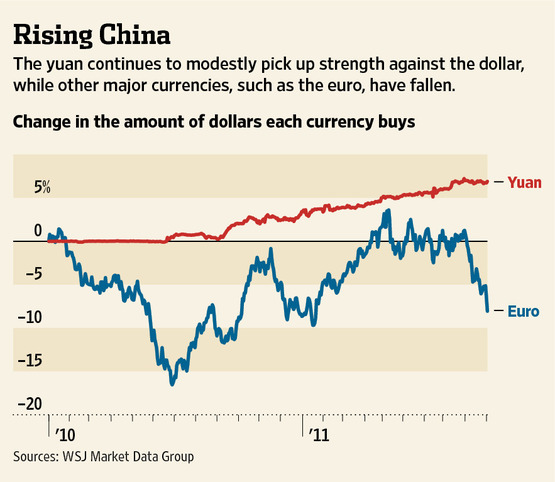

The Senate voted Monday to move ahead with a bill that would punish China for keeping the value of its currency low, drawing a harsh response from Beijing, which said the measure would severely hurt trade ties.

The bill, which lets lawmakers deflect some of the blame for the sour U.S. economy on another country, advanced in the Democratic-controlled Senate with a strong bipartisan vote of 79-19. But it has uncertain chances in the Republican-controlled House. Supporters complain that China's yuan is undervalued, making its products cheaper on world markets. They say a higher yuan would boost U.S. exports and create thousands of American jobs. Opponents say the measure would accomplish little besides infuriating China, and that the U.S.-Chinese relationship faces far bigger issues.

The People's Bank of China said Tuesday that factoring in inflation, the yuan has appreciated "greatly" and is close to a balanced level. China's Foreign Ministry said the bill violates rules of the World Trade Organization and that its passage would severely affect U.S.-China economic and trade relations.

A spokesman for China's Commerce Ministry said China is "deeply concerned" over the bill. Shen Danyang said in a statement Tuesday that one big reason for the U.S trade deficit with China is U.S. export controls on certain high-tech products to China, and called on the U.S. to improve the situation. Forcing yuan appreciation can't resolve the trade imbalance between the two countries or help reduce U.S. unemployment, he said.

The Senate vote puts the White House in a delicate position. Like previous administrations, the Obama White House is wary of antagonizing Chinese leaders, whose cooperation it needs not just on economic issues but also on an array of national security matters. But criticizing China remains popular with the public, and many Democrats, including those from big industrial states, say China's currency policy is unfair to U.S. workers.

"They use the rules of free trade when it benefits them, and spurn the rules of free trade when it benefits them," said Sen. Charles Schumer (D., N.Y.), a major sponsor of the bill. "For years and years and years, Americans have grimaced, shrugged their shoulders, but never done anything effective" to stop these policies.

Opponents of the bill say that instead of potentially sparking a trade war, the U.S. should face its own problems, such as the burgeoning federal budget deficit. "It's like we know what we've got to do but we won't do it," said Sen. Bob Corker (R., Tenn.). "It's like we've got to find a bogeyman."

Because House leaders are reluctant to bring up the bill, its future is uncertain. The House overwhelmingly passed a similar bill in September 2010, when Democrats controlled the chamber, but GOP leaders argue today that the new bill could have unintended consequences.

House Majority Leader Eric Cantor (R.,Va.) dodged questions about the legislation Monday, shifting the focus to the White House. "I'm curious as to where the administration is," Mr. Cantor said. "If there are unfair trade practices going on, we should look to our trade representative in the administration to address those."

The administration is saying little. "We share the goal that it represents, which is to achieve further appreciation of China's currency," said White House spokesman Jay Carney. But, he added, "it's important that as we pursue that goal, we do so in a way that is ... both effective and consistent with our international obligations."

Supporters hope political pressure will persuade House leaders to put the bill to a vote. In a reflection of the issue's potency, at least two Republican presidential candidates, Mitt Romney and Jon Huntsman, have come out in favor of punishing China for its currency policies.

"I hope the Senate vote today will wake up the administration. I hope the Senate vote today will wake up the House," Sen. Lindsey Graham (R., S.C.), who supported the bill, said after the vote. "Get off the sidelines."

Adding to the pressure, free-trade deals with Panama, South Korea and Colombia are coming before the Senate soon. Critics of the pacts say they will hurt American workers, and lawmakers who support the China currency bill may find it easier to vote for the trade deals.

The Senate bill would let the U.S. impose tariffs within 90 days on another country if the Treasury Department finds that its currency is "misaligned." That is a less rigorous standard than existing law, which requires a finding of intentional manipulation.

Many economists agree that China's decision to keep the yuan artificially low makes it harder for U.S.-based manufacturers, who buy their goods and pay their workers in dollars, to compete with Chinese rivals. But the actual impact on the U.S. economy is much disputed.

The International Monetary Fund calls China's currency "substantially" undervalued, but the exact amount is hard to pinpoint. The labor-backed Economic Policy Institute found recently that the U.S. trade deficit with China killed 2.8 million jobs between 2001 and 2010, but some challenge that finding. A St. Louis Federal Reserve study says a Chinese currency appreciation wouldn't produce U.S. jobs "to any meaningful degree," because a lot of the production work would shift elsewhere in Asia.

China has faced pressure for years to let the value of its currency rise. When the pressure heats up, the country usually boosts the value of the currency somewhat, including over the last few days. But with the global economy slowing, the Chinese central bank is bound to come under domestic pressure to slow the already moderate pace of currency appreciation. China also faces a leadership change next year, and it is unlikely that top Beijing officials, while jockeying for new jobs, would back a faster appreciation, which would be seen as helping the U.S. at the expense of China.

The legislation would also let individual industries petition the Commerce Department for tariffs on their competitors' products. As it now stands, a country's currency policies are considered too general a factor to warrant tariffs on specific goods.

Many business leaders, especially from global firms, are against the bill, and the U.S. Chamber of Commerce last week sent a letter to Senate leaders saying it would be counterproductive. But that position is not unanimous among businesses. Members of the National Association of Manufacturers are divided on the bill, so the group is not taking a position.

read more: Olympus Wealth Management

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment