Friday, 13 January 2012

Rivals Eye American Airlines (Video)

Potential buyers are circling American Airlines, weighing bids for its parent company that could place the storied but unprofitable carrier in the hands of a rival or a private-equity firm.

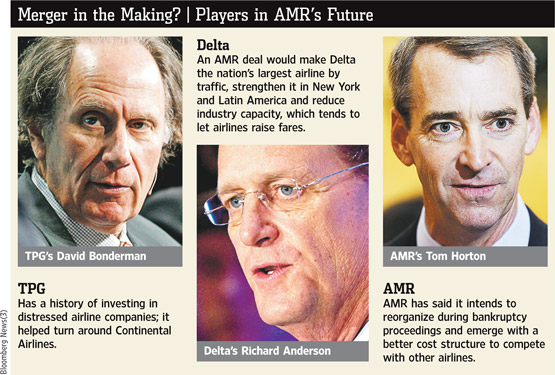

People familiar with the matter said Delta Air Lines Inc., US Airways Group Inc. and TPG Capital separately are studying bids for AMR Corp., which two months ago became the last of the big "legacy" airline operators to file for bankruptcy-court protection after a decade of industry consolidation.

American, which traces its roots back more than eight decades, has been losing money since 2008. Shorn of its hefty costs, however, the No. 3 U.S. carrier by traffic could be an attractive prize for Delta or US Airways, with hubs in markets including Chicago and Dallas and a strong overseas presence.

A deal for the carrier would represent perhaps the last major move in a wave of airline consolidation that has slashed the number of major national carriers to five from roughly triple that number two decades ago.

But any such deal could also bring sizable complications, and would likely draw close antitrust scrutiny from the government.

TPG Capital prefers to work with a strategic partner for a possible AMR investment, some of the people familiar with the matter said. The firm, which has long experience in the airline industry, has approached AMR about its interest, they said.

Delta has hired Blackstone Group as its financial adviser to study a potential AMR bid, people familiar with the matter said. Blackstone helped Delta restructure in its 2005 bankruptcy. US Airways also has retained advisers to help it assess a possible bid for AMR, said people with knowledge of the move.

Any bids for AMR likely wouldn't come for many months, people familiar with the matter said, and would hinge on its ability to use the Chapter 11 process to chop its labor costs, shed unwanted aircraft and mark down its contracts with suppliers.

A sale of AMR would require a bankruptcy judge's approval and input from parties such as the airline's creditors, who include the government's Pension Benefit Guaranty Corp., Boeing Capital Corp. and labor unions representing pilots. AMR's restructuring efforts could take anywhere from 12 to 18 months, and possibly longer, according to people familiar with the matter.

AMR's new chief executive, Tom Horton, said in a message to employees Thursday that the company is working on its restructuring business plan and proposals for new labor contracts, and hopes to put them forward "within the next few weeks." He warned again, as he did in his last employee communication, that the changes would be "difficult." Mr. Horton didn't address possible merger interest, and a spokesman declined to comment.

The U.S. airline industry has been consolidating almost since the first commercial airplanes took off, but the process has accelerated sharply in recent years, spurred by a spate of bankruptcy filings. The newly combined airlines have become more disciplined about their costs and the number of seats they offer, and have been able to push through price increases to cover historically high fuel prices. Such moves made most of them profitable in 2010 and 2011, raising the pressure on AMR to take similar actions.

After its merger with Northwest Airlines in 2008, Delta became the world's largest carrier by traffic, though it was later eclipsed by United Continental Holdings Inc. If Delta were to merge with American, the combined carrier would control 27% of the U.S. market, unless it was forced to divest assets to other carriers to satisfy antitrust concerns. It would quickly regain the No. 1 spot in traffic from United Continental.

Delta has conducted an antitrust analysis on a possible tie-up with AMR and concluded that, with some concessions, such a deal has a good chance of passing regulatory muster, people familiar with the matter said.

A Delta-American pairing would unleash a juggernaut in the trans-Atlantic market, where Delta is the top U.S. airline and American is a leading player. Such a combination also would boost American's capacity across the Pacific, where Delta's 2008 acquisition of Northwest has made it a formidable competitor.

In the U.S., the picture is more complex. A tie-up could cement Delta's hold on the huge New York market, where the Atlanta-based airline has fast been expanding and where American still has a strong presence. Delta also has hubs in Minneapolis and Detroit, which are smaller markets than American's nearby hub in Chicago. Delta's mega-hub in Atlanta isn't far from American's hub in Miami. Moreover, Delta's work force is mostly nonunion; American is highly unionized.

A marriage of AMR and US Airways might do more for the latter than the former. US Airways is the smallest of the major hub-and-spoke legacy airlines in the U.S. It has long wanted to hitch its wagon to another carrier, and AMR is the only large opportunity left. In 2010, US Airways talks with United parent UAL Inc. fell apart and UAL ended up doing a deal with Continental Airlines Inc. US Airways' hubs—in Phoenix, Philadelphia and Charlotte, N.C.—aren't in the largest U.S. cities, and it has relatively modest foreign operations. Tying up with AMR would bring it a rich Latin American portfolio, a larger European network and a towering frequent-flier plan.

Delta is an anchor member of global marketing alliance SkyTeam, which suggests that American might leave its current club, Oneworld, a move that would destabilize that alliance, which includes British Airways, Japan Airlines and LAN Airlines SA of Chile.

US Airways still is trying to resolve labor issues stemming from its 2005 merger with smaller America West Airlines, so taking on yet another set of unions by acquiring AMR would be a major challenge. As the larger partner, AMR probably would stay in the Oneworld alliance, and bring US Airways from its current home in the Star Alliance.

Mr. Horton alluded in a letter to employees in December to speculation AMR might be the target of a takeover while in bankruptcy. "And as we've seen before in this industry, there may be opportunists who wish to acquire our company," he said.

It is far from certain any deal will materialize. It isn't unusual for potential suitors to circle a company in bankruptcy proceedings and AMR has stressed it is focused on reorganizing and staying independent. AMR and its unions also are preparing for contentious labor talks that could go on for months.

TPG made one of its first investments in the industry in 1993 with Continental Airlines, which it helped turn around in the 1990s. TPG invested in America West, which merged with US Airways in 2005, and was part of a consortium that tried to acquire Qantas Airways Ltd. in 2007, but it didn't get the necessary shareholder approval for the deal.

TPG also has past ties with American Airlines. In 2009, the private-equity firm teamed up with AMR to possibly invest in Japan Airlines Corp., but the deal never came to fruition.

read more: Olympus Wealth Management

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment